The initial public offering (IPO) of Solar Philippines’ wholly-owned unit, Solar Philippines Nueva Ecija Corp. (SPNEC), was well-received by investors, with demand exceeding the amount of shares offered.

“SPNEC’s IPO was oversubscribed, receiving P5.3 billion in orders for the P2.7 billion offering, with strong demand from investors who want exposure to the first pure-play solar company to list on the PSE,” said SPNEC’s underwriter Abacus Capital and Investment Corp.

The oversubscription comes as the company’s IPO was already sized at the maximum of its indicative range of up to 2.70 billion shares at up to P1.00 per share, which would result in SPNEC having a market capitalization of P8.12 billion.

“We’re grateful for the public’s faith in our ability to turn this ‘powerpoint’ into a power plant, and hope our work can live up to these expectations,” said Solar Philippines founder Leandro Leviste.

SPNEC’s offer period ran from December 1 to 7. It is set to list on the Main Board of the Philippine Stock Exchange (PSE) on December 17.

It is also the 10th and final IPO for 2021.

SPNEC is also the first company to list under the Supplemental Listing and Disclosure Rules for Renewable Energy (RE) Companies approved by PSE in 2011 which provides exemption from the PSE’s track record and operating history requirements.

SPNEC is currently at the pre-operating stage and has not commenced commercial operations.

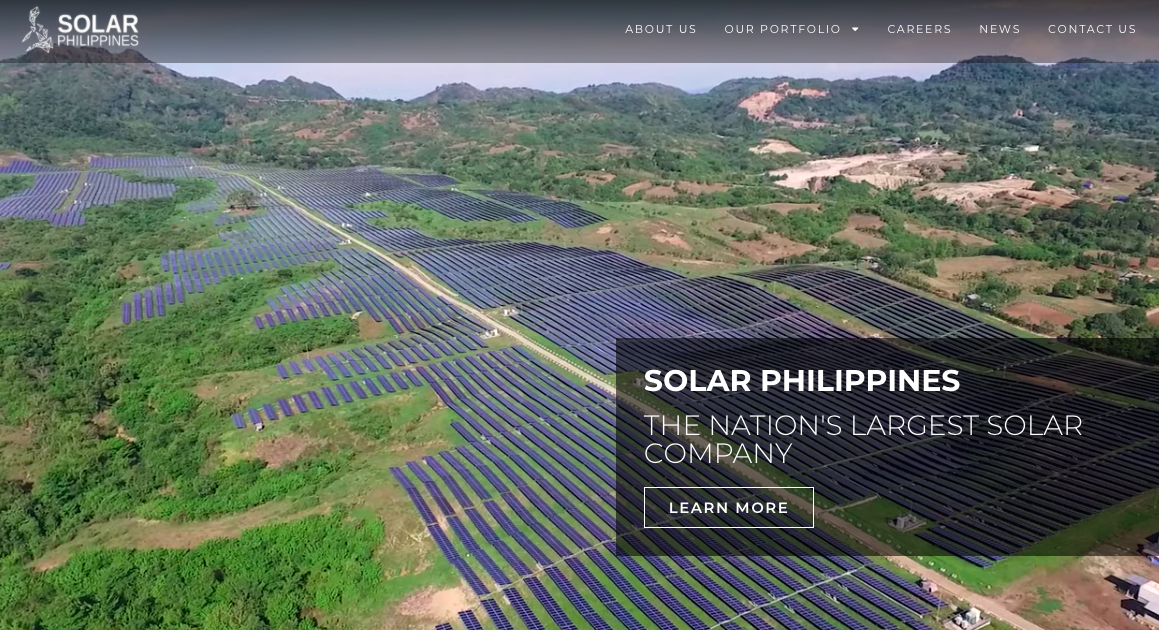

Proceeds of the IPO will be utilized by SPNEC for construction and development of its 50-megawatt solar project dubbed as Phase 1A, transmission line construction, lease for 2022, and general corporate purposes.

Capital raised from the offer will also be used to acquire land to expand the project beyond 500 MW, in support of SPNEC’s plan to develop the largest solar project in Southeast Asia.

Solar Philippines incorporated SPNEC in 2016 and secured a DOE service contract to develop the Nueva Ecija project in 2017, with construction planned to start by the end of 2021.

Once operational, the project is intended to supplement the Luzon grid’s thin reserves and help prevent rotating outages that affected millions of Filipinos earlier this year.

“We want to help the country’s power companies replace their future coal and gas developments with solar, so that together, we can make solar the largest source of energy in the Philippines,” Leviste said.

Solar Philippines’ other projects include one in Batangas with an operational 63 MW in partnership with Korea Electric Power Corporation; one in Tarlac, being expanded to up to 200 MW in partnership with Prime Infra of the Razon Group; and another two in Batangas and Cavite with a combined capacity of 140 MW planned to be fully operational by 2022.

SPNEC has engaged Abacus Capital and Investment Corp. as issue manager and lead underwriter and Investment Capital Corp. of the Philippines as participating underwriter for this IPO. — VBL, GMA News

Solar Philippines unit s IPO twice oversubscribed

Source: News Panda Philippines

0 comentários :

Post a Comment